What is a tax lot?

Each time you purchase a security, it creates a new tax lot. The tax lot contains the number of shares purchased, the cost basis and the purchase date. When you sell the security, the lot is closed and the sales proceeds are associated with the lot. If you only sell some of the shares in a single tax lot, the lot will be divided into two, separating the remaining shares from those that were sold.

How do I edit tax lots?

Any noncovered tax lot can be edited, with the exception of pending tax lots. You can also edit costs for securities purchased in your non-taxable and tax-deferred accounts.

Visit the Tax Information page, choose the time period and either realized or unrealized gain and loss information, then select View Gains & Losses. You can also get to this page by selecting the link in the “Total Gain Loss” column for a security on the account’s Holdings page.

For a taxable account, select Edit Tax Lot in the “Covered” column if it is available to you. For a non-taxable account select Edit Info in the “Unrealized Gain/Loss” column.

If you have more than 24 entries to make for a single security position, you can still enter this information by following these steps:

- Make your first 23 entries, enter the balance of shares not yet entered as the 24th entry and select Update Tax Lots.

- Then find the 24th entry on the Open Tax Lots page, select Edit Tax Lot, and repeat step 1 until complete.

What are open tax lots?

Every time you buy shares, an open tax lot is created to track the date and the price of the purchased security. When you sell the shares, tax lots allow us to automatically find the shares that help keep your taxes as low as possible.

With open tax lots, you can track the following information for each security you currently own:

- Purchase date

- Number of shares

- Total purchase cost

- Total current value

- Current gain or loss since purchase

- Short- or long-term status

Open tax lots will also be useful in the following ways:

- If you want to create capital losses, you can view open tax lots to find stocks that can currently be sold at a loss.

- If you bought the same security on different occasions, you will be able to view each purchase separately (taxable accounts only).

- If you bought the same security on different occasions, you will be able to view purchase dates to help prevent wash sales (taxable accounts only).

- If you transferred shares to us, you can go to your Open Tax Lots page to provide the purchase cost and purchase date for the shares. Once you’re on the page, simply find the transferred shares and select Edit Tax Lot.

If you have any specific questions about tax planning when you invest, seek the advice of a tax advisor or financial consultant.

Follow these steps to view your open tax lots.

- Select the Accounts tab.

- Select View Tax Information in the drop-down box next to the account, folio, or non-folio holdings that holds the securities you want to view and select Go.

- On the Tax Information page, select the button next to “View Open Tax Lots,” then select View Tax Information.

What are closed tax lots?

Every time you sell shares, a closed tax lot is created to track the date and price of your sale.

With closed tax lots, you can track the following information for each security you currently own:

- Purchase date

- Sale date

- Number of shares

- Total purchase cost

- Total sale amount

- Gain or loss amount

- Short- or long-term status of the sale

Closed tax lots will also be useful in the following ways:

- If you sold shares of the same security on different occasions, you will be able to view each sale separately (taxable accounts only).

- If you want to buy back a security you sold at a loss, viewing the sale date will help prevent wash sales (taxable accounts only).

Follow these steps to view your open tax lots.

- Select the Accounts tab.

- Select View Tax Information in the drop-down box next to the account, folio, or non-folio holdings that holds the securities you want to view and select Go.

- On the Tax Information page, select the button next to “View Closed Tax Lots,” then select View Tax Information.

What is the benefit of relieving tax lots at the account level?

The ability to apply tax management strategies on an account-wide basis will allow you to more efficiently tax manage portfolios. When securities are sold, the system maximizes the tax benefit by scanning across all of your folios in an account for the desired tax lot. While the most beneficial tax lot will be used at the account level, security sales continue to occur from the intended folio.

For example, assume the following transactions take place within an account:

- Buy 100 shares of security XYZ in folio 1 on April 1st for $10/share (total cost $1,000).

- Buy 100 shares of security XYZ in folio 2 on July 1st for $6/share (total cost $600).

- Sell 100 shares of Security XYZ from folio 2 on September 1st for $9/share (total proceeds $900).

In the past, the sale of shares from folio 2 would have resulted in the sale of the tax lot purchased in the same folio on July 1st. Selecting this particular tax lot would result in a short-term capital gain of $300.

With account level tax lot management, the system will look for tax lots across the entire account. With these changes, the tax lot purchased on April 1st is eligible to be selected. Choosing this lot will result in a short-term loss of $100. The actual lot selected will continue to depend on the inventory relief method selected for the account.

How do I provide the purchase dates and purchase prices (the tax lots) for shares transferred to you from another brokerage?

The purchase date and purchase prices including commissions (the cost basis) of your transferred shares can be found on the trade confirmations and statements from the brokerage firm that previously held your shares, if these are not transferred over automatically.

You can designate the tax lots of transferred shares by following these instructions:

- Select the Tax Information link on the Accounts page next to the name of the account or folio that holds the transferred shares

- Enter the security symbol(s) for the transferred shares, and then select View Tax Information

- Enter the purchase date and cost basis for your shares into the spaces provided

Note: Designating the tax lots of securities that you have transferred is important. It enables us to use our automatic tax tools to find and sell your shares that most advantageously fit the tax lot strategy you’ve chosen for your account.

What is a tax lot selection method?

Also known as inventory relief, the method you choose will determine the order in which your tax lots are realized and reported to the IRS, and could affect how much you pay in capital gains taxes.

Each time you buy shares of a security, you accumulate a tax lot. (If you buy 10 shares of Security XYZ once per day over a 5 day period, you will have 5 tax lots.) Tax lots purchased over 1 year ago are considered long-term and are taxed at a lower rate than those purchased less than 1 year ago, which are deemed short-term. If you are investing consistently, over time you will accumulate many tax lots, and inevitably some will gain value and some will lose value (unrealized gains and losses).

When you decide to sell shares of a security, tax lots will be automatically selected based on the tax lot selection method you have chosen. The sold tax lots are now called realized gains or losses. After deducting losses, any remaining gains will be taxed at either your short-term capital gains tax rate or your long-term capital gains tax rate.

For example, if you have purchased 10 shares of Security XYZ once a month over a 2-year period, you have 24 unrealized tax lots, 12 short-term and 12 long-term, and a combination of gains and losses. If you choose to sell 10 shares, one of those 24 tax lots will be automatically selected to be realized.

We offer 10 methods which use different criteria to determine which of those tax lots will be reported as sold. Some use time as the only parameter. For instance, if First In – First Out is your tax lot selection method, the oldest tax lot will be realized, regardless of whether it is a gain or loss. Others use value to determine the order. Maximize Losses/Minimize Gains would sell your largest loss first, regardless of whether it is a long- or short-term loss. We also offer options that create more complex results that take both time and value into consideration. Additionally, we offer two tax rate weighted options which personalize the selection to take into account the capital gains tax rates you enter as applicable to you.

What are the automated tax strategies?

Strategies to Minimize Capital Gains

- Maximize Losses/Minimize Gains, Tax Weighted

Sell shares in the order of largest effective tax loss to largest gain, adjusted based on your capital gains tax rates. - Maximize Losses/Minimize Gains

Sell shares with the largest losses first, largest gains last, regardless of long- or short-term tax status.

Strategies to Maximize Capital Gains

- Maximize Gains/Minimize Losses, Tax Weighted

Sell shares in the order of largest effective tax gain to largest loss, adjusted based on your capital gains tax rates. - Maximize Gains/Minimize Losses

Sell shares with the largest gains first, largest losses last, regardless of long- or short-term tax status.

Other Strategies to Manage Capital Gains and Losses

- First In – First Out

Sell shares in the order that they were purchased from oldest to most recent. - Last In – First Out

Sell shares in reverse order of purchase from most recent to oldest. - Maximize Short-term Losses

Sell shares with short-term losses (large to small), then long-term losses (large to small), then long-term gains (small to large), then short-term gains (small to large). - Maximize Long-term Losses

Sell shares with long-term losses (large to small), then short-term losses (large to small), then short-term gains (small to large), then long-term gains (small to large). - Maximize Long-term Gain

Sell shares with long-term gains (large to small), then short-term gains (large to small), then short-term losses (small to large), then long-term losses (small to large). - Maximize Short-term Gain

Sell shares with short-term gains (large to small), then long-term gains (large to small), then long-term losses (small to large), then short-term losses (small to large).

How do I change my automatic tax lot trading selection?

The default setting when you open an account is the Maximize Losses/Minimize Gains selection. To change this setting:

- Go to the Settings page.

- Find the account you want to update, select Tax Lot Selection and follow the instructions on the page.

What are weighted inventory relief methods?

The weighted methods make use of user-provided tax rates to ensure that the tax lots that are most beneficial to that user will be sold first. These methods are the best way to either minimize or maximize how much you will owe in capital gains taxes, because they are the only methods that create a unique order of tax lot relief based on your long- and short-term tax rates.

- To reduce the amount owed in capital gains taxes choose Maximize Losses/Minimize Gains, Tax Weighted.

- To increase the amount owed in capital gains taxes choose Maximize Gains/Minimize Losses, Tax Weighted.

See an example illustrating how we determine the order tax lots are relieved:

- Maximize Losses/Minimize Gains sells shares with the largest losses first, largest gains last, regardless of long- or short-term tax status.

- Maximize Losses/Minimize Gains, Tax Weighted adjusts short-term gains/losses based on capital gains tax rates. Sell shares in the order of largest loss to largest gain.

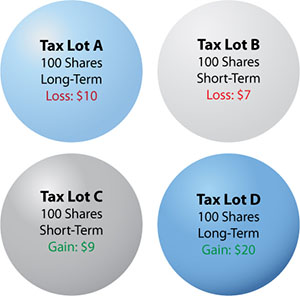

Here are four tax lots of security XYZ. We will refer to the tax lots as Tax Lot A through D. Each tax lot is labeled with the number of shares, its gain or loss per share, and its status (whether it is a long-term or short-term tax lot).

Long-term tax lots were purchased more than one year ago.

Short-term tax lots were purchased within the past year.

-

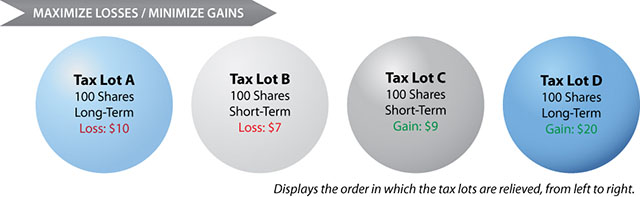

Maximize Losses/Minimize Gains

Using the Maximize Losses/Minimize Gains method, the shares are sold, or relieved, from largest loss to largest gain.

If the account holder sells 100 shares, he will sell Tax Lot A.*

- 100 shares of Tax Lot A multiplied by $10 per share equals a $1,000 long-term loss.

- The $1,000 loss can be used to offset other sales that had a long-term capital gain.

- The tax savings from realizing this loss, assuming a long-term rate of 15%:

$1,000 × 15% = $150

-

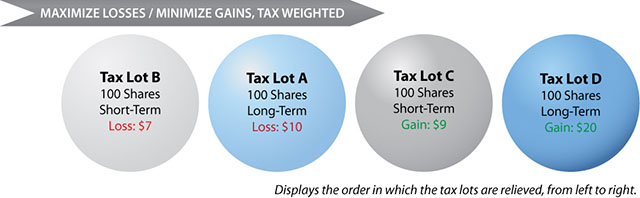

Maximize Losses/Minimize Gains, Tax Weighted

The Maximize Losses/Minimize Gains, Tax Weighted method also sells shares from largest loss to largest gain, but first, it will adjust the tax lots based on capital gains tax rates. In order to select this method, the long-term and short-term tax rates for the account holder must be provided. We will determine the factor by which we will weigh the tax lots.

Short-term tax rate → 33% = 2.2 ← Factor Long-term tax rate → 15% The tax weighted method is using the factor to give more weight to the short-term tax lots because they are taxed at a higher rate. The table below shows an equation for each tax lot, where the gain or loss is multiplied by the factor, resulting in a weighted gain or loss.

Tax Lot Status Gain or

Loss /ShareMultiply by Factor Equals Gain or

Loss/Share

WeightedA LT $(10) × 1 = $(10) B ST $(7) × 2.2 = $(15.4) C ST $9 × 2.2 = $19.8 D LT $20 × 1 = $20 Note: The “Gain/Loss Weighted” column, created by the factor, is a mechanism used to determine the order in which tax lots are sold. The value of the tax lot does not change.

Using the number in the “Gain/Loss Weighted” column we have a relief order that differs from the Maximize Losses/Minimize Gains method.

If the account holder using this method were to sell 100 shares, he would sell Tax Lot B.*

- 100 shares of Tax Lot B multiplied by $7 per share equals a $700 short-term loss.

- The $700 loss can be used to offset other sales that had a short-term capital gain.

- The tax savings from realizing this loss, assuming a short-term rate of 33%:

$700 × 33% = $230

- In this example, the tax savings is $80 larger than the savings realized using the Maximize Losses/Minimize Gains method because the tax rate differential makes a smaller short-term loss more valuable than the larger long-term loss.

- The same logic makes the weighted method beneficial when selling lots with a capital gain. Because of the tax rate differential, short-term gains are increased by the weighting factor when determining the order that the tax lots are relieved.

*This example has been simplified to illustrate differences between two inventory relief methods. In this example, we have assumed a long-term tax rate of 15% and a short-term tax rate of 33% based on an income of $250,000 or less.

How can I provide tax information if I transferred shares to you?

If you transferred shares to us, you should provide their tax lots—the date you purchased the shares and the total purchase price (including commissions) that you paid for the shares. This information is needed to determine your taxes.

“N/A” will appear in the “Estimated Gain/Loss” column if you have not provided tax lots.

When you sell the shares, tax lots allow us to automatically find the shares that fit the tax lot selection method you’ve chosen to keep your taxes as low as possible.

You will not be able to enter this information after you sell the shares.

Follow these steps to provide this information.

- Select the Settings link.

- On the Settings page, select View Tax Information from the drop-down box next to the name of the account that holds the shares.

- On the Tax Information page, select the button next to “View Open Tax Lots,” then select View Tax Information.

- Find the transferred shares and select Enter Tax Lot.

Review trade confirmations and statements from your former brokerage to determine the purchase date and total purchase price. If you have not kept these records, you may be able to obtain the information by contacting the brokerage.

If you have provided this information, but feel you entered it incorrectly, follow these steps to edit the information.

- Select the Settings link.

- On the Settings page, select View Tax Information from the drop-down box next to the name of the account that holds the shares.

- On the Tax Information page, select the button next to “View Open Tax Lots,” then select View Tax Information.

- Find the transferred shares and select Edit Tax Lot.

What information can I find on the Tax Lot Details page?

Tax lot details will be divided between short-term sells and long-term sells.

Each security will be listed in a separate row. The rows will contain the following information in order from left to right:

-

Symbol

The trading symbol for the company you own security in.

-

Security

The name of the company you own security in.

-

Purchase Date

The date the security was purchased.

-

Shares to Sell

The estimated number of shares you are selling based on last transaction prices that are at least 20 minutes old. Keep in mind that the last transaction may have occurred more than 20 minutes ago. The number of shares we actually sell may fluctuate depending on price movements between now and the time the order is executed.

-

Total Cost of Shares

Price paid for the shares × Shares to Sell.If you purchased the shares on more than one occasion, we will combine the total cost for all purchases. -

Total Current Value of Shares

Shares to Sell × last transaction prices that are at least 20 minutes old.Keep in mind that the last transaction may have occurred more than 20 minutes ago. The number of shares we actually sell may fluctuate depending on price movements between now and the time the window closes. -

Estimated Gain/Loss

If

Current Total Value of Shares > Total Cost of Shareswhen the order is executed, the sale will result in a gain.If

Current Total Value of Shares < Total Cost of Shareswhen the order is executed, the sale will result in a loss. If a loss is expected, the estimated gain/loss amount will be in parentheses.If the shares you are selling were transferred to us from another brokerage, and you have not provided their purchase date and cost, “N/A” will appear. Select “provide the missing information” on the right side of the page to learn how you can provide the missing information.

The estimated gain/loss is based on last transaction prices that are at least 20 minutes old. The actual gain/loss may differ once the order is executed. Keep in mind that the last transaction may have occurred more than 20 minutes ago.

-

Totals

The shares to sell, total cost of shares, total current value of shares, and estimated capital gains/losses are totaled at the bottom of the page.

What are the benefits of controlling my taxes through tax lots?

You may dramatically reduce your taxes and boost your returns if you keep track of the date and price that you purchase each share, and you sell the exact shares that save the most in taxes. That’s a big if for investors who don’t have the time or the patience to keep and analyze detailed trading records on their own.

We have an easy solution. We keep track of tax information for you by creating a “tax lot” record each time you buy a security and reinvest cash distributions (dividends, capital gains, and return of capital).

How do tax lots work?

When you sell shares, your tax bill depends on the profit or loss and how long you have owned the shares. If you owned the shares for less than a year, your profits will be taxed at the short-term rate, the personal income tax rate. If the shares were held for more than a year, the long-term capital gains rate of 20% applies.

Do you have an example of how tax lots work?

At most brokerage firms and mutual funds, selecting the specific shares you are selling is so difficult that you give up on managing taxes. This costs you money because what really counts is the after-tax return on investments. Choosing the best securities to sell from a tax perspective can increase your returns dramatically.

Example

Assume you purchased shares of the same security on 2 different occasions creating 2 tax lots.

- On February 1, you purchase $2,000 for $20 per share (100 shares).

- On August 1, you purchase $2,500 for $25 per share (100 shares).

Total holdings are 200 shares. Two years later, you want to sell $1,500 of the security. The market price is $30 per share, so you decide to sell 50 shares.

If you sell from the February 1 tax lot the capital gains on each share will be $10 or $500 for 50 shares. If the shares come from the August 1 tax lot the capital gains on each share will be only $5 or a total of $250.

| Purchase Date | Tax Lot | Shares Bought | Purchase Price | Shares Sold | Sale Price | Profit | Tax |

|---|---|---|---|---|---|---|---|

| February 1 | 1 | 100 | $20 | 50 | $30 | $500 | $100 |

| August 1 | 2 | 100 | $25 | 50 | $30 | $250 | $50 |

Most brokers require you to use the First In – First Out method, unless you write a letter stating which shares to sell. If you used First In – First Out, you would owe the higher amount, $100, in taxes.

On the other hand, your account is set to “Minimize Gain or Maximize Loss” whenever you sell, unless you change it to another of our eight tax lot selection methods. Our system automatically sells from the August 1st tax lot.

With the click of a button, your taxes have decreased from $100 to $50.

What is the difference between a long-term and short-term gain?

If you sell a security held for one year or less, the profits are taxed at the short-term rate, the personal income tax rate. The current federal personal income tax rates are 15%, 28%, 31%, 36%, and 39.6%.

If you sell a security held more than one year, profits are taxed at the long-term capital gains rate, which is 20% in most cases. If your income tax rate is 15%, then your long-term rate will be 10%.

If you sell security at a capital loss, and in any given year the losses are greater than gains, you can deduct the losses from your income for tax purposes. A maximum of $3,000 can be deducted each year. Any losses beyond $3,000 can be carried forward and deducted from future yearly income figures.

The holding period begins the day after you buy a security. One year from the beginning of the holding period, long-term capital gains rates go into effect. For example, if you bought 100 shares of security on June 1, 2000, the holding period begins on June 2, 2000. Long-term rates go into effect on June 2, 2001.

What are the eight tax lot methods I can choose from?

-

First In – First Out

This sells the shares you bought first.

-

Last In – First Out

This sells the shares you bought last.

-

Minimize Gain or Maximize Loss

This sells the shares in the order of largest loss to largest gain.

-

Maximize Gain or Minimize Loss

This sells the shares in the order of largest gain to largest loss.

-

Minimize Long-Term Gain

This sells the shares that you have held for more than one year first in the order of largest loss to largest gain. If you do not have enough long-term shares to meet your sell orders, shares you have held for one year or less will be sold in the order of largest loss to largest gain. This means that long-term gains will be sold before short-term gains or short-term losses.

-

Minimize Short-Term Gain

This sells from the shares you have held for one year or less first in the order of largest loss to largest gain. If you do not have enough short-term shares, shares you have held for more than one year will be sold in order of largest loss to largest gain. This means that short-term gains will be sold before long-term gains or long-term losses.

-

Maximize Long-Term Gain

This sells from the shares you have held for more than one year first in order of largest gain to largest loss. If you do not have enough long-term shares, some of the shares you have held for one year or less will be sold in order of largest gain to largest loss. This means that long-term losses will be sold before short-term gains or short-term losses.

-

Maximize Short-Term Gain

This sells from the shares you have held one year or less first in order of largest gain to largest loss. If you do not have enough short-term shares, some of the shares you have held for more than one year will be sold in order of largest gain to largest loss. This means that short-term losses will be sold before long-term gains or long-term losses.

How do I select among your eight choices?

We give you eight choices for controlling taxes that are explained above.

When you open an account, we automatically select a choice that applies universally to all sell orders, “Minimize Gain or Maximize Loss.” You can change this setting when you open an account or by selecting the dropdown option on the Accounts page. The change you make will apply universally, every time you sell shares.

If you want to maintain a universal setting and change the setting for just one trade order, you can do so from the page where you place a trade. The setting will change for that one order but automatically revert back to your universal setting for all future sales.

How will I receive tax information?

At the end of the year, we will send you a statement listing the dividends received and the short- and long-term capital gains and losses for securities you sold. This list can be attached to your Internal Revenue Service Schedule D or downloaded into popular tax calculation programs.

Do we store tax lots for non-taxable accounts?

Tax lot records are not kept for non-taxable or tax deferred retirement accounts. Because you pay no taxes when you sell securities in a retirement account, it is not necessary to record specific tax lots or choose a tax lot method. You will still be able to track the performance and capital gains of non-taxable accounts based on the average cost per share.

How can I view securities and determine if they have long- or short-term gains or losses?

- Select the Accounts tab.

- Find the account or folio that holds the securities you want to view.

- Select View Tax Information from the drop-down box next to the account or folio’s name and select Go.

- On the Tax Information page, select the button next to “View Open Tax Lots,” then select View Tax Information.

How can I view the estimated capital gains and losses as I am placing a trade?

The Preview & Place Order page shows the estimated short- and long-term capital gains for your order.

Select the Tax Lot Details button on the Preview & Place Order page to see short- and long-term capital gains for each security.

How can I view the actual capital gains and losses for an executed trade?

- Select the Accounts tab.

- Find the folio where the trade took place.

- Select View Tax Information from the drop-down box next to the folio’s name and select Go.

- On the Tax Information page, select the button next to “View Closed Tax Lots,” then select View Tax Information.

Can I deduct fees or commissions when I sell a security?

In general, you will owe tax when you sell security and make a profit after subtracting brokerage fees.

What is a non-taxable account?

You do not pay taxes on trading profits in a non-taxable retirement account. Retirement accounts are either “tax-deferred,” such as a regular individual retirement account (IRA) or “non-taxable,” such as a Roth IRA account.