What securities can I trade here?

You can invest in almost all securities listed on the major U.S. equity exchanges and in more than 1,000 mutual funds and exchange-traded funds. We also offer a series of unique FDIC-insured cash investment products.

We do not currently trade foreign listed securities, over-the-counter (OTC), pink sheet, bulletin board, or debt securities, nor do we offer options trading or margin lending.

How do I buy and sell bonds?

We offer exchange-listed fixed income ETFs and many closed-end bond funds, but we do not offer individual bonds.

How do I rename a folio?

To rename a folio:

- Select the Settings link

- Scroll down to the “Account Information” section and select the Folio Name link next to the folio you want to rename.

How do I create my own folio?

To create a personalized folio:

- Select the Add New Folio link on the Accounts page

- Follow the detailed instructions on the page to create your own folio by adding individual securities, or by using other available methods

You can build your own folio by selecting individual stocks, or transferring shares between folios or non-folio holdings in the same account. Also, you can invest in as many folios as you would like at no additional charge.

Where can I find mutual fund prospectuses?

Before you invest in a mutual fund, we recommend that you carefully read the mutual fund’s prospectus for details on the fund’s objectives, strategies, management fees, and other expenses.

How does a stock split affect my account?

On the effective date of the split, the newly adjusted share quote is reported on your Holdings page. However, be aware that the number of shares will not be adjusted until our overnight cycle. All adjustments are made (number of shares and quotes) by market open the following business day.

How long do I have to hold a stock to get a dividend payment?

The key date to remember for dividend paying stocks is the ex-dividend date. When a company declares a dividend, it sets a record date, which is when you must be in the company’s books as a shareholder in order to receive a dividend from the company. Once the company sets the record date, the stock exchange that the company is affiliated with determines the stock’s ex-dividend date (which is normally set for two business days before the record date).

How can I view the estimated capital gains and losses as I am placing a trade?

When you are placing a trade request, you will see the Preview Order page. Select the Tax Lot Details link on this page to see estimated short- and long-term capital gains for each security.

Note: Open tax lots may not accurately estimate unrealized gains or losses due to the 20 minute delays in price reporting and the fact that an actual transaction has not yet occurred.

What is an automatic buy/sell?

Automatic buy/sell allows you to invest or remove a specific amount of money in a folio each month. You decide how much money to invest or remove and when the transaction will occur. You can set up as many automatic buy/sell orders as you want for each folio. Automatic buy/sell is a great way to maintain a disciplined investing schedule.

We offer several ways to set up an automatic buy/sell each month. Keep in mind that each security in your folio makes up a percentage, or weight, in a folio.

- Buy at Current Weights

Will buy more of each security at its current weight in the folio at the time the order is placed. - Buy at Target Weights

Will buy more of each security at its target weight in the folio. - Buy Rebalance

Will buy the securities that will bring the folio closer to its target weights, without selling any securities. - Sell at Current Weights

Will sell each security at its weight in the folio at the time the order is placed. - Sell Rebalance

Will sell the securities that will bring the folio closer to its target weights, without buying any securities.

After setting up an automatic buy/sell, you can modify or delete it by selecting Automatic Buy/Sell on the Accounts page.

If you do not have enough unallocated cash in your account for your buy order, we will skip the request for the month and try again the following month.

If you do not have enough securities in the folio for your sell order, we will process the order as a “sell all” order.

All automatic buy/sell orders will abide by the currently active security exclusions at the time the trade is placed, even in cases where the remaining assets are not sufficient to satisfy the entire sell request.

How can I ensure I have enough cash to make an automatic buy?

Setting up an electronic funds transfer (EFT) is a good way to ensure you have enough cash to support your automatic buys. EFTs typically take 2–3 business days, so we suggest you set up your monthly EFT at least five days prior to your automatic buy day.

Select Set Up EFT from the “Transfer Money” part of the Accounts page to get started.

How do I build my own folio with Folio Loader?

Folio Loader is a fast and efficient way to build new folios or to update your existing ones. It gives you the ability to create or modify a folio by typing in your securities and weights, by copying and pasting a list of security symbols and weights, or by uploading a spreadsheet.

-

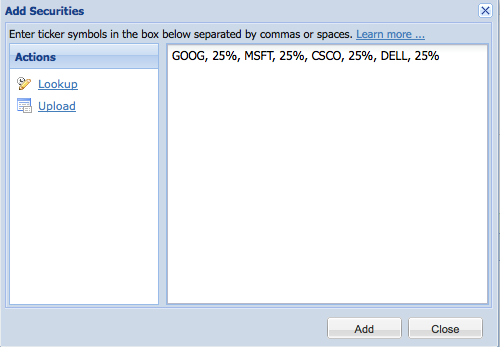

Type or Paste in Securities

Folio Loader lets you type in your security symbols and weights, as well as copy and paste security symbols and weights from almost any editable data source. Type or paste securities into the input window separated by spaces, commas, or line breaks. You can enter the target weight for a security in this window, or on the following page.

Example

-

Upload Securities

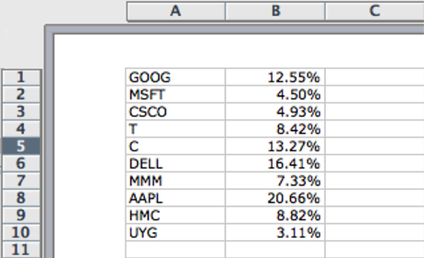

Folio Loader supports uploading from most major spreadsheet file formats, including text delimited (.TXT or .CSV) and excel (.XLS or .XLSX) formats.

For a spreadsheet to upload correctly, you must format it with your securities in the first column and their corresponding target weights in the second column. You should not use column headers, or have any breaks in your data. Other data in the spreadsheet will be ignored.

Example