It’s smart to invest consistently in a diversified portfolio and rebalance your holdings periodically.

But that requires a lot of transactions, which could generate huge commissions at other brokerages. And many mutual funds and ETFs charge asset-based fees—so your cost is a percentage of your investment in the fund. As your investment grows, its price tag grows with it. What’s good for business is not necessarily good for you.

We think you should be able to do the smart thing without worrying about paying more to do it.

That’s why under our Folio Unlimited Plan, you can make, basically, an unlimited number of commission-free window trades,* in an unlimited number of accounts (all joint, custodial, retirement, and individual accounts under the same taxpayer ID), and create, use, or modify an unlimited number of folios, all for only $290 per year.

Costs Have Consequences

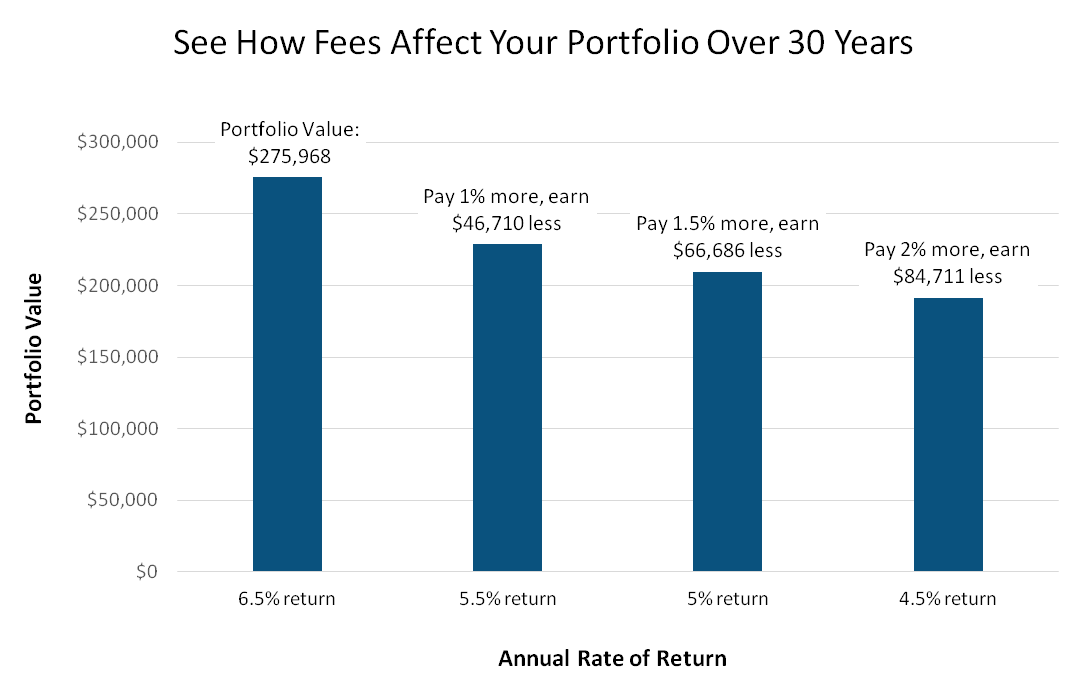

Every dollar you pay in fees and trading commissions is money that will never go to work for you. And the value of those lost dollars compounds over time.

Even 1% can make a big difference—you could earn 20% more by paying 1% less.

Let’s say you make an annual investment over 30 years, earning 6.5% each year.

What happens if you make the exact same investment, but pay an extra 1% in expenses?

Or 1.5%? Or 2%?

The difference is dramatic.

Mutual Fund Costs

Even no-load mutual funds aren’t free. When you invest in a fund, the management and operational costs—expressed as the fund’s expense ratio—are taken directly out of your returns as an asset-based fee. The average expense ratio of stock mutual funds is about 1.37%.1

But mutual fund costs don’t stop there. Funds are not required to report their trading costs to investors, and as a result, investors are subject to additional “invisible” fees. A recent study published by the Financial Analysts Journal2 and reported on in U.S. News and World Report3 estimates that investors pay an average of 1.44% per year in trading costs on top of the expense ratios. That makes the combined total average cost of owning a mutual fund almost 2.81% per year.

Our Cost Advantage

Think of it as worry-free pricing. You can do what’s right for your portfolio without commissions and fees getting in the way.

Always know what you’re paying. With the Folio Unlimited Plan pricing your costs remain low no matter how many securities you invest in or how often you rebalance them.*

And if you fill your folios with stocks, you can diversify without incurring the high asset-based fees common to other investment products.

This is another example of the Folio Advantage. Flat-fee pricing gives you freedom to invest the way you want—and the way smart investing says you should—without the worry of increasing costs.*