You can choose from many different options for trading, reporting, and other administrative tasks.

Buy and Sell Individual Stocks/Funds or Entire Folios

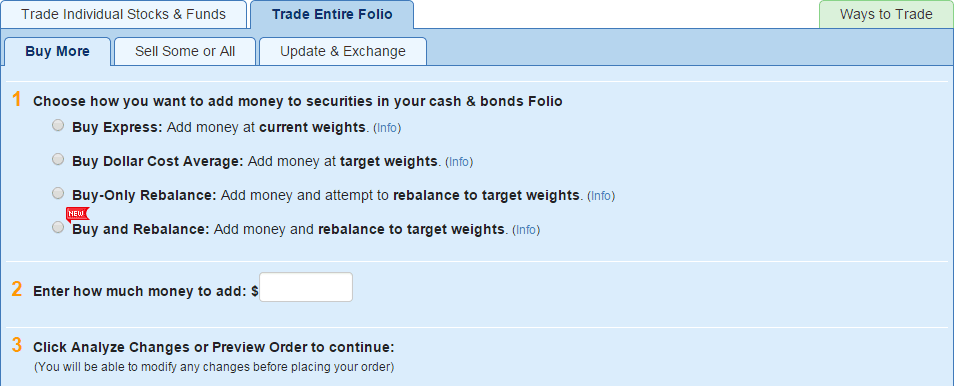

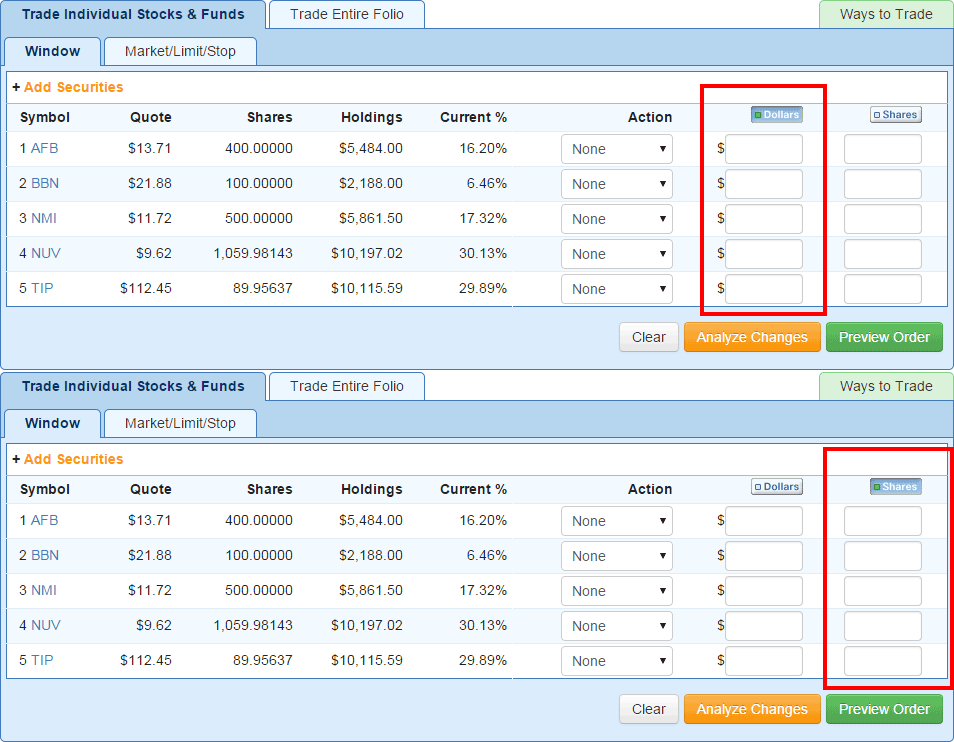

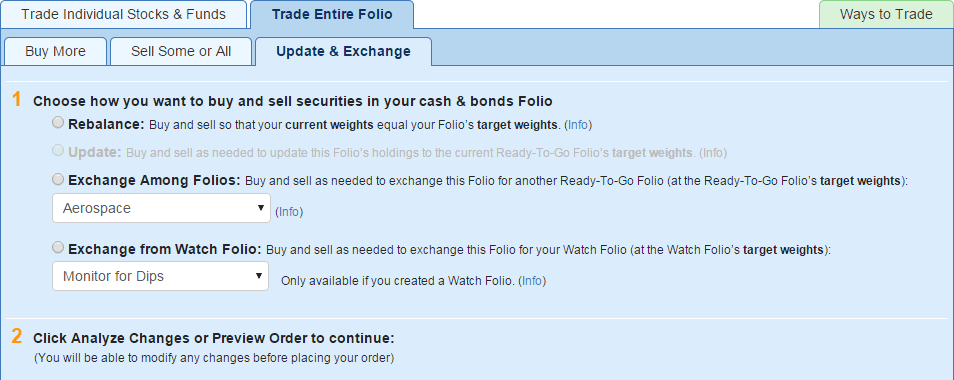

Trade individual stocks and funds—or entire folios. With our management tools, it’s easy to buy and sell a number of stocks and funds at once. Our folio trading capability means that you don’t have to create separate orders for each security transaction. Instead, we do the work for you, allowing you to buy and sell the stocks in an entire folio as a single transaction—with up to 100 different securities in each transaction. Whether you want to buy securities, add money to existing positions, or sell some or all of an investment—you can do it easily with FolioTrade.®

Invest in Dollar Amounts

You are not limited to buying and selling whole shares of stocks when you invest with us using our patented window trades. You have the freedom to invest the exact dollar amount you want with dollar-based investing, which also makes rebalancing and auto-investing possible and easy. For example, you can invest $1,000 per month across an entire folio of 100 stocks, even if that means you are buying only a quarter share of each stock.

Weight Your Folios

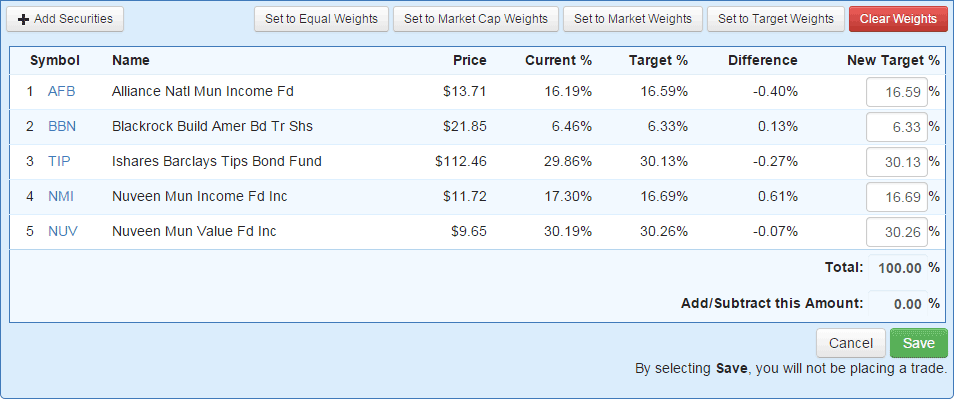

At other brokerages, you manage your portfolio by buying and selling whole shares of stock. Because you can trade partial shares with us, you always own exactly the proportion of each security you want.

By setting the percentage of a stock you want to own, target weights, and using dollar-based investing, managing entire folios is easy. Simply set the weights of the stocks in your folio when you create it. Every time you invest money in a folio afterwards, your target weights will be used to calculate how much to invest in each security. You can change folio target weights with one click so they’re the same for every security—or use weights set by market capitalization, the current weights of your holdings, or any custom weights you chose.

For example, if you want to add $1,000 to a folio that has Google weighted at 10%, we will automatically buy $100 of Google in that folio, and allocate the other $900 among the rest of your stocks. You can easily change the weights in an entire folio with each trade.

Rebalance Your Folios

As the value of your securities changes over time, their weights in the folio will also change relative to the original weights that you set. You could end up owning too much of some securities and not enough of others. You will want to rebalance your ownership percentages if you want to maintain your original strategy.

When you rebalance your folio, you buy and sell precise amounts of your holdings to bring your holdings current weights back into line with your target weights. Routine rebalancing is important for maintaining appropriate diversification and keeping your investment plan on track. It can be a complicated task for many investors, but FolioTrade® is the tool to accomplish precise rebalancing in seconds.

Why Rebalance?

Rebalancing is part of good portfolio management. As some securities go up in value and others go down, the ones that have gone up become a greater percentage of your portfolio than you intended—causing you to be less diversified than you targeted. When folios are rebalanced regularly your investments don’t become over-weighted in some securities and under-weighted in others.

Example

Let’s say you have a folio of 20 securities that are equally weighted. When you buy the folio, each security represents 5% of your investment. During one year, three of the securities rise dramatically to the point that they represent 30% of your folio. Since these securities now represent a greater weight of your folio’s value, they have a larger impact on the overall performance of your folio. This increases your risk and decreases your level of diversification. To get your folio back in shape, you need to sell some of these three over-represented securities and buy more of the other securities.

Rebalancing evens out the weights of the securities in relation to one other—it’s the smart thing to do.